CFIE supports the business owner and wants to provide relevant M&A information for free where possible. CFIE also wants to contribute to a prosperous and efficient European economy. Hence, we want to explain relatively complex content in a simple way to prevent misunderstandings. In this article, we will give our thoughts on the difference between enterprise value and equity value. Also, we will explain how the topic of a cash-free, debt-free balance sheet relates to working capital specifically, and equity in general. The objective of this article is to describe enterprise value and equity value from a different point of view, so it helps business owners to get some understanding of this topic.

Content of this article:

- At the start: Why are enterprise and equity values important?

- Enterprise value: The main determinator for the value of your company

- Equity value: The quality of your balance sheet

- Working capital: What is its role in the equity value?

- Simple graphics to help understand equity value

- Making equity value more complicated: the grey area in practice

- Practical misunderstandings by business owners

- Conclusions about equity value (versus enterprise value)

At the start: Why are enterprise and equity values important?

Do you plan to sell your business? If so, you need to have some basic understanding of enterprise and equity value as both terms are often used in M&A processes. Usually, this topic creates confusion and misunderstanding. Hence, it is important to work on the relationships continuously in any transaction and have open communication. Without a proper understanding of both enterprise value as well as equity value, the seller could get the wrong idea about the valuation of the company. Please keep reading to find out why these terminologies and their meanings are important and how it relates to your specific company sale.

Enterprise value is what your company is worth. Equity value is what you, as a business owner, get in your pocket. Often there is not much difference between these two. However, that depends on the structure and quality of your balance sheet.

Enterprise value: The main determinator for the value of your company

The primary purpose of both enterprise and equity value is the same, which is to represent the worth or value of a company or a business. The enterprise value (EV) represents the total value of the company including both its equity and debt. This value is intended to reflect the future earning potential of the company and is often calculated by multiplying a normalized measure of operational profits (EBITDA) by a chosen multiple.

We do not talk about this multiple in this report, as it is subjective and influenced by different factors. In M&A processes, enterprise value is much more common, as it removes the capital structure from the equation and therefore companies are more comparable to each other. It is important to realize, that whenever we are talking about enterprise value it does not tell the whole story. We could end up with a situation where two sellers with the same enterprise value could receive a different net amount after they have sold their businesses. This is because those two companies had different capital structures.

Equity value: The quality of your balance sheet

The equity value is important, as this is what an owner receives in the end for the sale of its company. At the time of the acquisition process, the target company most probably has debt and cash on its balance sheet. For this reason, it is generally agreed that the acquisition will be on a debt-free and cash-free basis. This means that the buyer will not inherit any of the debt and cash of the target company. The process will make the necessary adjustments on the balance sheet and after that, we arrive at the equity value. Equity value = enterprise value – total debt + free cash

If we compare it with the sale of a house, then the enterprise value would be the final sale price. However, if we have a mortgage and cash in the house then first, we must pay off the debt and remove the cash before we sell it. The equity value is the value that remains after debts have been paid off and cash has been taken out from it. Just to sum it up: Enterprise value = equity value + total debt-free cash.

So, in the end, the equity value depends on the quality of your balance sheet. If you made a lot of historic profits and have not taken many dividends in the past, you will likely have free cash. Then, it is time to be rewarded for this via a higher equity value.

Working capital: what is its role in the equity value?

A buyer will demand normal working capital to operate a business. This will mostly be positive working capital. The difficult question is to determine what a normal level of working capital is. This will always be arbitrary.

In practice, often the normally required working capital is determined based on a historic working capital level from previous years. In case a company is growing quickly, and there is more working capital required, it might be wise (from the point of view of the buyer) to compare to the working capital level of the last 12 months or even the last 6 months.

It also matters what is taken as a definition of working capital. Is it just the concise trade working capital (debtors and creditors) or a much broader definition of working capital that includes the non-trade working capital? In any case, the higher the agreed required working capital level, the lower the equity value.

Simple graphics to help understand equity value

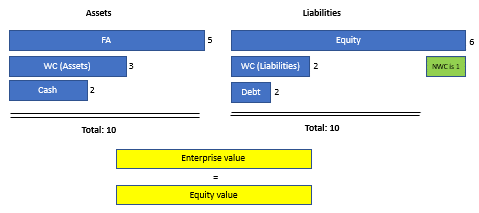

Situation 1

If we assume the agreed net working capital is 1.

Then, the equity covers the fixed assets and the agreed net working capital, there is no free cash (nor net debt). In this case, the equity value is the same as the enterprise value.

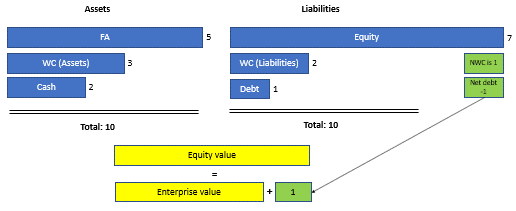

Situation 2

Again, assume the agreed net working capital is 1.

In this case, the equity covers the fixed assets, the agreed net working capital and leaves some free cash. In this case, the equity value is the enterprise value plus 1.

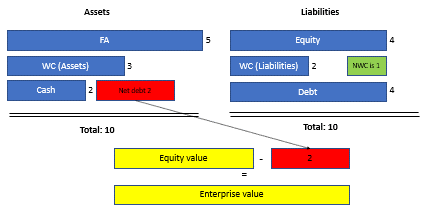

Situation 3

Assuming the agreed net working capital is 1.

In this case, the equity does not cover the fixed assets and the agreed net working capital. In this case, there is net debt, and the equity value is the enterprise value minus 2.

Making equity value more complicated: the grey area in practice

In practice, a balance sheet is often much longer and much more complicated. There are many items that will not be considered being part of the working capital. Some items might be considered as debt-like items or in contrast, cash-like items. Examples of debt-like items can be overdue payments to suppliers or advance payments from customers. These items should not be considered as a part of the normal net working capital anymore. Another debt-like item can be a backlog in capital expenditure (CAPEX) payments. The CAPEX is part of the normal operations, but the payment for it has not been made yet.

So, in practice, advisers, buyers, or owners might try to massage the numbers to their advantage. Here is where an experienced adviser can help and support in a smooth process. In case you, as a business owner, have any questions we are always open to giving some free advice.

Practical misunderstandings by business owners

There are definitely some clear misunderstandings by business owners that we see in practice. That is due to the lack of experience with practical business sales. This can be a showstopper or dealbreaker in many cases. Misunderstandings or different opinions both exist in the enterprise value as well as in the equity value. Here we focus on misunderstandings in the equity value. Some examples we have seen in practice:

- Many owners think the historic equity belongs to them. This is, in the end, what they have worked for and earned themselves they feel. However, equity is required to operate the business and covers the fixed assets and the net working capital. Any buyer will want to acquire a functioning business with fixed assets and sufficient net working capital.

- One owner asked for a realistic enterprise valuation. However, in addition to this, the owner wanted to get compensated for inventory. This large inventory could be sold in his opinion and had a huge value. However, in that case, any potential buyer then needs to build up and acquire new inventory himself. A normal net working capital is required to operate the company.

- One owner indicated he had an extremely large stock to supply his clients faster than the competition. Hence, he had large working capital but wanted to agree on a much lower normal working capital which would leave him more free cash. However, this high inventory allowed him to ask for higher prices as he could deliver more quickly. Hence, in this case, one needs to calculate with a higher working capital level.

- Many owners want to take out all the cash that is on the balance sheet. However, this free cash needs to be seen in relationship to the equity, the assets available, the net working capital, and possible debt-like, and cash-like items. Hence, it is quite likely that the actual level of free cash to be taken out is lower than what is on the balance sheet at the date of closing.

Conclusions about the equity value (versus enterprise value)

Based on our practical experience, one can see that the determination of a correct equity value (and enterprise value) that is acceptable for all parties involved is a tricky project. Managing and keeping good personal relations between the seller and buyer is crucial in this process. Misunderstandings or disagreements on these numbers should be prevented by sharing common, well-substantiated calculations. A basic or ideally good understanding of this topic is helpful to make a business sale a successful project.

What is your opinion on how the equity value impacts business sales?